Efile 1099s Quickbooks For Mac

Use QuickBooks Online and the 1099 E-File Service to e-file your 1099-MISC forms with the IRS. Note: When going to the next or previous step in any part of the Prepare or E-File 1099 processes, use the available buttons in the page instead of using the browser navigation buttons.

Use QuickBooks Online and the 1099 E-File Service to e-file your 1099-MISC forms with the IRS. Note: When going to the next or previous step in any part of the Prepare or E-File 1099 processes, use the available buttons in the page instead of using the browser navigation buttons. • • Prepare 1099s • E-file 1099s • • Print & Mail to the IRS • Returning to 1099 E-file Service • 1099 Transaction Detail Report • State Filing • FAQs & Troubleshooting • Related Articles Prepare 1099s in QuickBooks Online • Review company details. • After preparing 1099s, you will have the option to choose whether to e-file or manually print and file your 1099s. • Select E-file for me if you choose to e-file. • Select I'll file myself if you choose to submit it manually. • If you select Print and mail forms, it opens a new page to print 1099 forms in.pdf format.

When you use Microsoft Outlook 2010 or Outlook 2013 and have multiple accounts delivered to different *.pst files, Outlook doesn't use the default account set in Account settings for new messages. Instead, it uses the account associated with the mailbox or *.pst file you have in focus. Set up outlook email on mac. I am using Outlook 2010. I have created a UNIFIED INBOX and if I delete an email from the UNIFIED INBOX it will delete the message off my other devices. If I try and delete the message of one of my devices it does not delete it out of the UNIFIED INBOX. Hi, I'm using Microsoft Outlook for Mac 2011 to send/receive emails from 3 different email accounts. At present all my emails are displayed in one inbox. Am I able to create 3 separate inboxes i.e. Undoubtedly, Outlook 2010 stands out when it comes to managing multiple email accounts, but it does not present any direct way to create a single Inbox folder, containing all mails from different email accounts. First, I would like to be able to view and interact with all of my emails from each of my 3 email accounts through one folder or inbox (whatever it would be called) in Microsoft Outlook. So, instead of going through each of the email inboxes, I would like to be able to click on one folder or one inbox and be able to see emails that are in all 3 of my accounts.

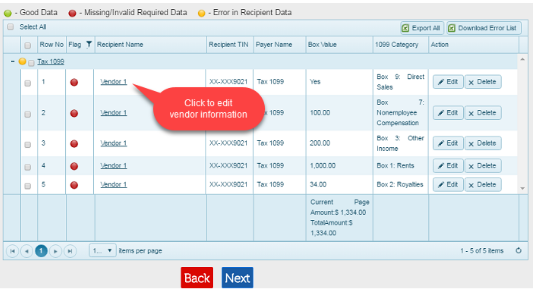

Please refer to To print and mail your forms section below.  E-File your 1099s The 1099 E-File Service will copy your company information from QuickBooks Online. You will be prompted to enter any information that cannot be imported. Your phone number must have 10 digits and must be entered without parenthesis or dashes. • Verify your 1099 Forms, then select Continue.

E-File your 1099s The 1099 E-File Service will copy your company information from QuickBooks Online. You will be prompted to enter any information that cannot be imported. Your phone number must have 10 digits and must be entered without parenthesis or dashes. • Verify your 1099 Forms, then select Continue.

• This information is not imported from QuickBooks Online. First time users will be prompted to enter billing and credit card information.

E-checks are not accepted by the 1099 E-File Service. • Review the Number of forms, and the Total Amount, then Approve. • You may see a window to choose the delivery option for contractor copies. If you do not see this option, you have already opted-in to provide your contractors online access to their 1099s and we will print and mail a copy to your contractors via First-Class Mail. (Continue to the next step.) If you do see this screen and select Yes, you will be asked to verify or enter missing email addresses for your contractors. If you select No, no further action is needed. Select Continue.

• V erify or enter missing email addresses for your contractors. • All contractors with email addresses will receive an invite to access their 1099 forms online. See this section of for more details. • If an email address is incorrect, you will need to go back to QuickBooks Online to update the contractor's email address, and then go back through the 1099 e-file flow. • If the email address field is left blank, we will still e-deliver the 1099 copy to the email address previously saved in your QuickBooks Online account.

The Download a copy of each 1099 for your records link will provide you the following 1099 copies: • Employer: Copy 1 & Copy C • Contractor: Copy B & Copy • Printed Copies • When you e-file through Intuit, we will also mail a printed copy to your contractors via First-Class Mail at no additional cost. Contractors can expect their copy in the mail within 1-2 weeks after you e-file.

Note: Mailings to your contractors will include your company information as the return address. • Select Continue. • Download and Submit 1099 Forms. • View forms: This button will only give you the Copy A that we sent to the IRS. Other 1099 copies are available in Home page, in Download step. To go back, select Back to Home at the top left.

• Submit final forms: Make sure that you have reviewed the 1099 forms before clicking this button as we do not handle corrected forms. Important: • Once 1099s are submitted, they cannot be modified. • Paper Version of Copy A of Form 1099 is for your records ONLY. You should not print or mail this form to the IRS. • Submission Confirmation. This page appears once you submit the 1099 forms.